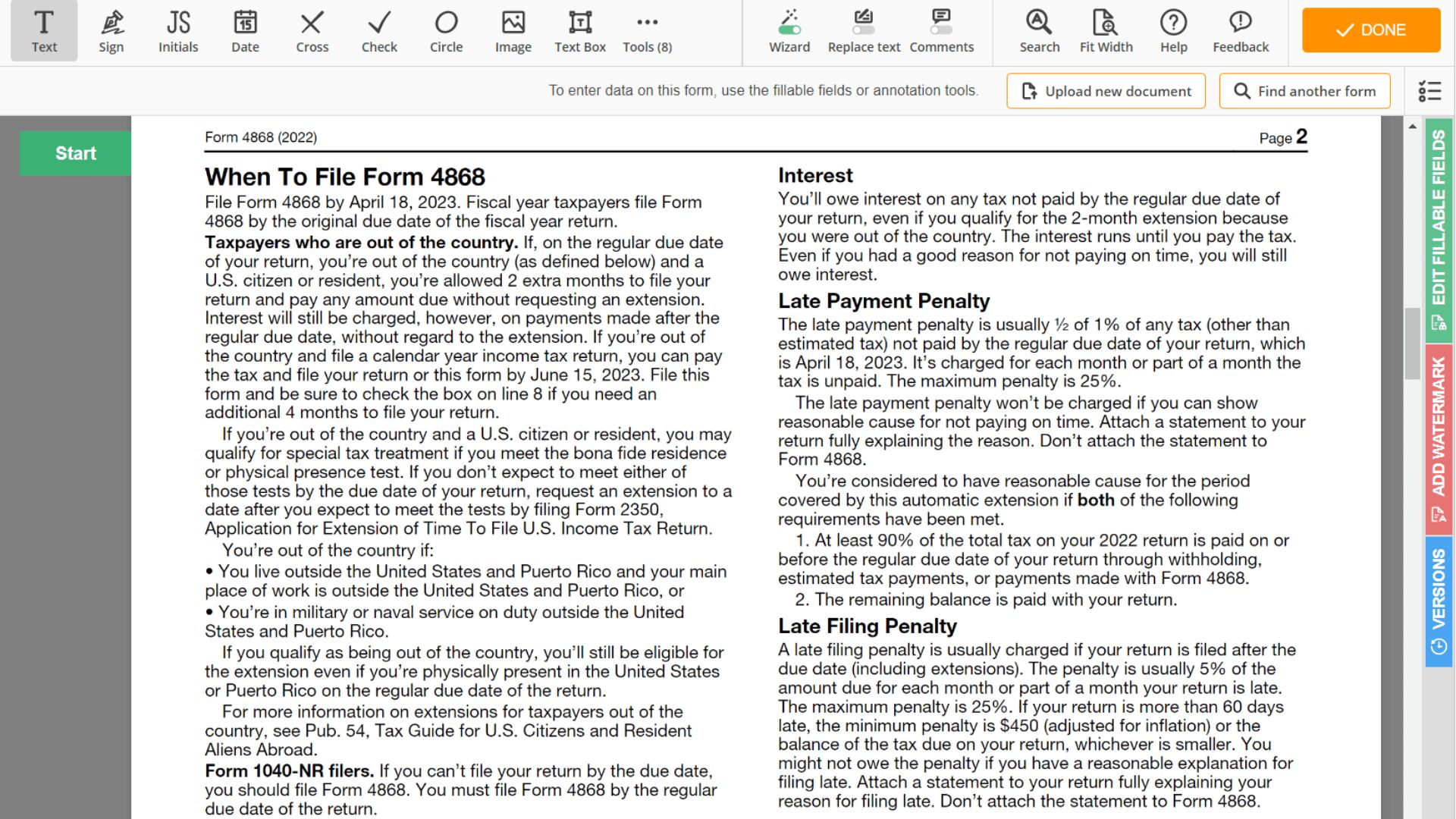

It’s a document used by taxpayers in the United States to apply for an automatic extension of time to file their federal income returns. It is important to note that IRS tax form 4868 for 2022 doesn’t extend the time to pay taxes, so taxpayers should still estimate and pay it by the original due date to avoid any penalties or interest.

The website 4868-form-printable.us is a valuable resource for those looking for help to fill out their printable IRS tax form 4868. Our website provides comprehensive instructions and examples, making it easier to understand the process. We also has an easy-to-use application that allows users to fill out the 4868 form right away and get it submitted quickly. This can save time, as well as provide peace of mind that the document is being filled out correctly. In addition, we offer tips on how to maximize deductions, as well as advice on filing deadlines and other important information. All of this information can help taxpayers make sure they are getting the most out of their tax returns.

Federal Form 4868 Features

Filing the IRS Form 4868 for 2022 printable or online is mandatory for those individuals and businesses that need to file a federal tax return but need an extension of time to do so. This sample can be filled out and filed online, printed from a blank template, or downloaded from the IRS website in a PDF or printable format, along with federal tax form 4868 instructions for 2023.

Besides, it may be exempt for specific individuals and businesses to use IRS tax extension form 4868. These exemptions include the following:

- Students, teachers, and military members on active duty in a combat zone.

- Victims of federally declared disasters, including wildfires and floods.

- U.S. citizens living abroad with a filing deadline of June 15th.

- Spouses of active military personnel stationed outside the U.S.

- Individuals and businesses with a valid IRS extension of time to file already granted.

- Individuals and businesses with an approved Offer in Compromise.

- Individuals and businesses with an installment agreement already established.

- Individuals and businesses that do not owe any taxes.

Individuals who need additional time to gather and organize their financial information, including income reported on Form 1099, may use Form 4868 to request an extension. The extension provides an extra six months to file the tax return, but it doesn't extend the time to pay any taxes owed. Follow the link to get the free blank 1099 form (PDF) for the last tax year.

Step-by-Step Filling Guide

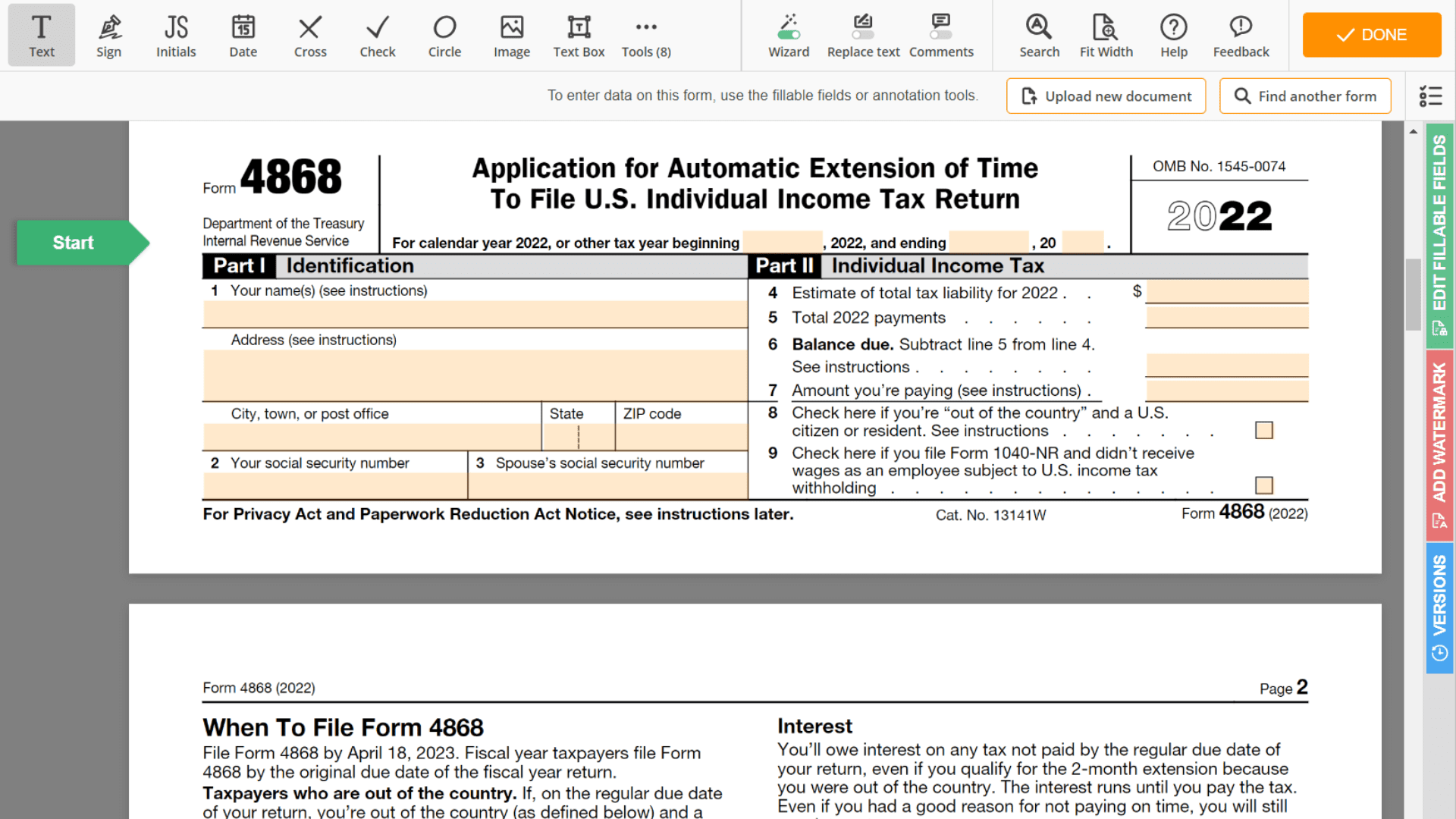

Filling out IRS extension form 4868 printable accurately is essential for filing a federal tax return. Here's a step-by-step guide on how to do it:

- Download the blank tax form 4868 PDF from our website or find a printable version online.

- Read the instructions carefully. They will provide important information about the template and how to fill it out correctly.

- Enter your name, address, and Social Security number.

- Enter the estimated taxes you owe for the 2022-2023 tax years.

- Sign and date the copy.

- Print out the filled-in template and keep a copy for yourself.

- File form 4868 online or by mail.

If you need help filling out the template correctly, you can refer to sample form 4868. This will give you an idea of what information you need to enter. Following these steps will help you successfully file your federal tax return.

More 4868 Form Instructions

- Is fillable form 4868 for 2022 free to use?

Yes, the fillable Form 4868 for the 2022 tax year is free to use, and it can be accessed online through the IRS website. It is also available in PDF format and can be printed out for free. - Where can I find the 4868 tax form to print out for free?

You can find the free blank template for the current year on our website, it’s available in PDF format and printable. It’s provided with instructions to help taxpayers fill out the sample correctly. - What is due for filing IRS form 4868 extension printable?

The deadline for filing a copy is April 15, 2023. However, taxpayers can request an extension to October 15, 2023, by submitting a copy to the IRS. It is important to note that submitting the sample doesn’t relieve you from paying the taxes due. - Is there an example form 4868?

Yes, there is a sample available on the IRS website. It is a blank template that you can use as a guide to filling out the PDF correctly. It also provides instructions on what information must be included in the copy. - Is the extension form allows you not to pay taxes?

Filing an extension form does not allow you to avoid paying taxes. It only gives you additional time to file your federal tax return without penalty. Taxpayers must still pay their taxes due by the original due date, or they may be subject to penalties and interest.

How to File IRS Form 4868

How to File IRS Form 4868

Form 4868 Introduction

Form 4868 Introduction

Form 4868 Filling Guide

Form 4868 Filling Guide

IRS Form 4868 Alternatives

IRS Form 4868 Alternatives

Printable 4868 Form: Filling Guide

Printable 4868 Form: Filling Guide